Agreeing a dwelling (ANAH)

Are you a landlord of one or more dwellings and do you rent out or wish to rent out your dwelling? All the information below.

I would like to conclude a rental agreement with Anah

I am a landlord and I would like to have information about the housing agreement

What is housing covenanting?

The Loc'Avantages system for landlords.

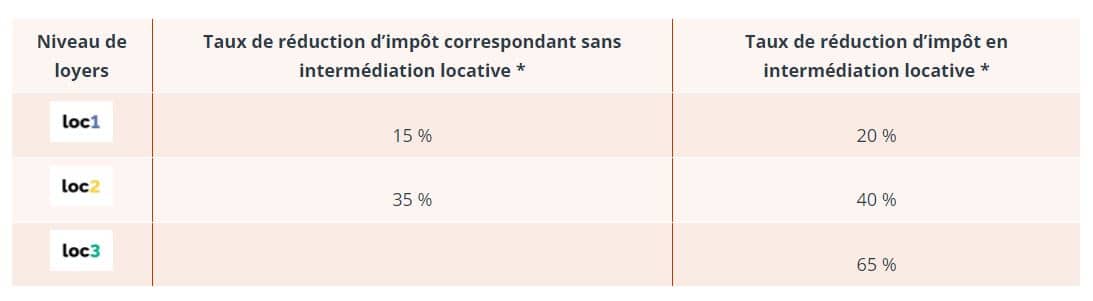

This contract is an interesting solution that allows the owner to obtain a tax deduction of 15% to 65% on his or her gross land income, depending on the rent charged (see table opposite) for a period of 6 years, whether you opt for an agreement with or without work.

To do this, the owner undertakes to rent his or her accommodation to people with a certain income ceiling(see the ceilings) and at a rent that does not exceed a certain threshold.

What are the advantages of agreeing to my accommodation?

You can choose the type of agreement you want, with the possibility of benefiting from financial aid to renovate your property or improve its energy rating and/or from rental management aid when you use the rental intermediation mechanism, in addition to an attractive tax system.

F.A.Q Anah

- Owner-occupiers", i.e. owners who occupy their home. Their level of resources must not exceed a certain ceiling

- Landlords", i.e. people who own one or more properties and who rent out or wish to rent out with or without carrying out work

- Co-owners' associations for work on common areas

- They must be for a minimum amount of €1,500 excluding tax, except for owner-occupiers with "very modest" resources, for whom no threshold is required.

- They must not be started before the grant application is submitted to the Anah.

- They must be included in the list of eligible works (link document). This excludes both minor maintenance or decoration work alone and work that can be assimilated to new construction or extension.

- The work included in the project must relate to an Anah intervention priority: treatment of substandard or very degraded housing, thermal renovation of housing and the fight against fuel poverty, adaptation of housing to loss of autonomy due to disability or ageing, recovery of co-ownerships in difficulty

- They must be carried out by building professionals.

The dwelling must have been completed at least 15 years before the date of notification of the decision to grant the subsidy.

Yes, the subsidy is never automatic. The decision is taken at local level. To do so, national priorities are adapted according to the specific contexts of each territory and the means available. Each project is studied from its different aspects: economic, social, environmental and technical.

Until 31 December 2020, this obligation applied only to energy renovation work that was subject to an RGE qualification and mentioned in Article 46AX of Annex III to the General Tax Code.

Work not mentioned in article 46AX of Annex III of the CGI (such as ventilation, removal of oil tanks, electric radiators, double and single flow ventilation, DHW, etc.) was not subject to compulsory execution by an RGE company (whether or not the qualification exists).

However, from1 January 2021, the nomenclature of EGR work has been substantially modified (redefinition of its scope and name, new categories of work).

For all applications submitted from this date onwards, new work must be carried out by an RGE company (electrical emitters, control equipment, ventilation, air-to-air heat pumps, etc.). For more information on the work, please refer to the ADEME's RGE 2021 guide, which will soon be published.

- Not to exceed the maximum rent set by the Anah;

- To rent, as a principal residence, to persons whose resources are below the nationally fixed ceilings;

- Do not rent to close family members;

- If the tenant leaves during the period covered by the Louer Mieux contract, the property will be re-let under the same conditions as provided for in the contract.

Since1 July 2020, the agreement without work is conditional on achieving a minimum level of energy performance.

The retroactive decree of 10 November 2020 requires that the taxpayer who signs an agreement without work with the Anah provide proof of a conventional primary energy consumption of the dwelling of less than 331 kWh/m2/year, equivalent to an E label.

Only new covenants are concerned, theenergy label does not need to be checked in case of extension of an existing covenant.

I would like to establish the agreement for my accommodation

Documents to be downloaded, printed and provided to us.

You will print and provide us with :

- 2 copies of agreements (social or intermediate depending on your choice)

- 1 copy of the lease

- 1 copy of the tenant's IR

- 1 proof of surface area (DPE, notarial deed, etc.)

- if SCI, kbis and statutes of the latter

- ECD in the name of the current owner

You will have 2 months, from the day of signing the lease, to provide us with all the documents

Send the documents to the following address or drop them off directly (open to the public on Mondays from 2pm to 4pm and Fridays from 9am to 11am): Perpignan Méditerranée Métropole -Direction des Solidarités - 11 Boulevard Saint-Assiscle, 66000 PERPIGNAN

All documents must correspond with each other. For example, the surface area of the dwelling indicated on the lease will be the same as that indicated on the agreement or commitments. In addition, if the landlord's accommodation is in the name of Mr and Mrs, the agreements and undertakings will be signed by both parties equally.

Make an appointment

Physical reception without appointment on Fridays from 09:00 to 11:00.

Telephone reception in the morning from 09:00 to 11:30.

- 04 68 06 60 89