Community Tourist Tax

Find the answers to all your questions concerning the collection and payment of the community tourist tax.

I declare my tourist tax

Declare your tourist tax online on the Perpignan Méditerranée Métropole website. If the formalities cannot be completed online, the paper declaration must be sent to us.

Which municipalities are concerned?

Since 1 January 2019, the tariffs, set by the Urban Community of Perpignan Méditerranée Métropole, apply to the entire territory (except for LE BARCARES, which has decided to keep the management of the tax). Municipalities concerned :

F.A.Q. tourist tax

The tourist tax is a contribution from people who do not live in the municipality to finance expenditure intended to develop tourist numbers and the influence of the destination (development of promotional activities, development of the territory, events, etc.).

Collected by the accommodation providers, it is paid to Perpignan Méditerranée Métropole, which pays the municipal share to the Perpignan Méditerranée Tourisme Office and the additional tax to the Conseil Départemental des PO (66).

Find out the applicable rates per person liable for tax and per night's stay: See the 2021 rates

Do you own a flat, a parking space or a tourist hotel and are not sure whether you have to pay a tourist tax? Find out which types of accommodation are concerned by the tourist tax. Whether they are managed by professionals or by a private individual, the following types of accommodation offered for rent are liable to pay a tourist tax:

- The Palaces

- Campsites

- Furnished tourist accommodation

- Tourist hotels

- Caravan sites

- Guest rooms

- Tourist residences

- Tourist car parks

- Homestays

- Collective hostels

- Holiday villages

- The marinas

The tourist tax is collected from any person who stays at least one night for a fee on the territory of Perpignan Méditerranée Métropole and who is not domiciled or does not have a residence in the municipality of the rented property. The following are exempt from the tourist tax

- minors

- holders of a seasonal employment contract employed in the municipality

- beneficiaries of emergency or temporary rehousing

- persons occupying premises where the rent is less than €8/day per person liable to pay.

- Declaration at the town hall by submitting the CERFA form n° 14004*04 for furnished accommodation (not obligatory for rentals of the main residence) and / or n° 13544-03 for bed and breakfast accommodation.

- Display the rates of the tourist tax in its accommodation and show them on the invoice given to the customer, separately from its own services.

- From 1 January to 31 December, collect the tourist tax before the guest leaves.

- Declare online on the Perpignan Méditerranée Métropole website, or on paper:

-The number of people accommodated and the number of nights

-Reasons for exemption, if any

-The amount of rent charged for unclassified structures

-The amount of tourist tax collected

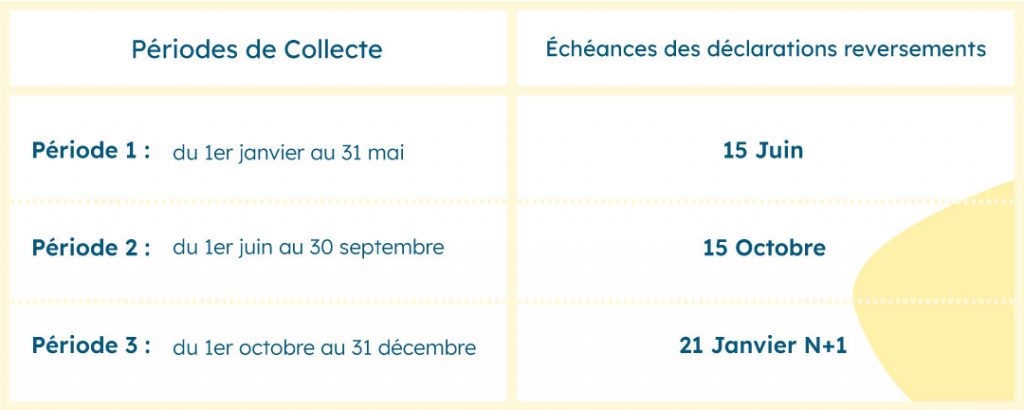

- Remit the tax according to the following schedule:

A period without a stay must be declared as "0 stay" (unless mentioned in the CERFA declaration for the rental of the furnished accommodation or bed and breakfast).

The platforms and real estate agencies, which act on behalf of renters and are payment intermediaries, collect and pay the tourist tax to Perpignan Méditerranée Métropole.

Paying the tourist tax by post

The paper declaration, together with the Declaration formand the Register of hirers and the payment by cheque made out to "Régie de taxe de séjour PMM", should be sent to the following address

- 04 68 08 61 59

At the request of the accommodation provider, the forms (DECLARATION FORM and RENTER'S REGISTER) can be sent to him by the tax management service.